Some Known Factual Statements About Amur Capital Management Corporation

Some Known Factual Statements About Amur Capital Management Corporation

Blog Article

Amur Capital Management Corporation Things To Know Before You Get This

Table of ContentsTop Guidelines Of Amur Capital Management CorporationHow Amur Capital Management Corporation can Save You Time, Stress, and Money.Amur Capital Management Corporation Things To Know Before You Buy3 Easy Facts About Amur Capital Management Corporation ShownAmur Capital Management Corporation Things To Know Before You Get ThisOur Amur Capital Management Corporation PDFsNot known Facts About Amur Capital Management Corporation

A low P/E proportion might suggest that a business is underestimated, or that financiers anticipate the firm to face harder times ahead. What is the excellent P/E proportion? There's no best number. Nonetheless, capitalists can utilize the average P/E ratio of other business in the exact same sector to create a baseline.

The smart Trick of Amur Capital Management Corporation That Nobody is Discussing

A supply's P/E ratio is simple to discover on a lot of financial coverage sites. This number suggests the volatility of a supply in comparison to the market as a whole.

A supply with a beta of above 1 is in theory extra unstable than the market. For instance, a safety and security with a beta of 1.3 is 30% more unpredictable than the market. If the S&P 500 surges 5%, a supply with a beta of 1. https://calendly.com/christopherbaker10524/30min.3 can be expected to rise by 8%

Fascination About Amur Capital Management Corporation

EPS is a dollar number representing the portion of a firm's revenues, after tax obligations and participating preferred stock returns, that is designated to every share of ordinary shares. Financiers can utilize this number to evaluate exactly how well a business can deliver value to shareholders. A higher EPS begets higher share costs.

If a firm on a regular basis falls short to provide on revenues projections, an investor might intend to reconsider buying the stock - best investments in copyright. The computation is easy. If a business has a web income of $40 million and pays $4 million in dividends, then the staying amount of $36 million is split by the number of shares superior

The Greatest Guide To Amur Capital Management Corporation

Financiers commonly obtain interested in a supply after checking out headlines regarding its phenomenal performance. A look at the pattern in costs over the previous 52 weeks at the least is needed to obtain a sense of where a stock's price might go following.

Technical experts brush through huge quantities of data in an initiative to forecast the direction of supply costs. Essential evaluation fits the demands of the majority of capitalists and has the advantage of making excellent sense in the genuine globe.

They think costs follow a pattern, and if they can figure out the pattern they can exploit on it with well-timed professions. In recent years, innovation has actually made it possible for even more financiers to practice this style of investing since the tools and the information are much more easily accessible capital management than ever before. Essential experts think about the inherent value of a stock.

The Buzz on Amur Capital Management Corporation

Much of the principles talked about throughout this piece prevail in the essential expert's globe. Technical evaluation is finest fit to a person that has the moment and convenience degree with information to place unlimited numbers to utilize. Or else, essential evaluation will fit the requirements of a lot of capitalists, and it has the advantage of making great feeling in the actual globe.

Brokerage fees and common fund expenditure proportions pull money from your profile. Those expenditures cost you today and in the future. For instance, over a period of 20 years, yearly costs of 0.50% on a $100,000 financial investment will decrease the portfolio's value by $10,000. Over the very same period, a 1% fee will certainly reduce the exact same portfolio by $30,000.

The fad is with you (https://ca.enrollbusiness.com/BusinessProfile/6689516/Amur%20Capital%20Management%20Corporation). Take advantage of the fad and shop around for the lowest price.

The Amur Capital Management Corporation PDFs

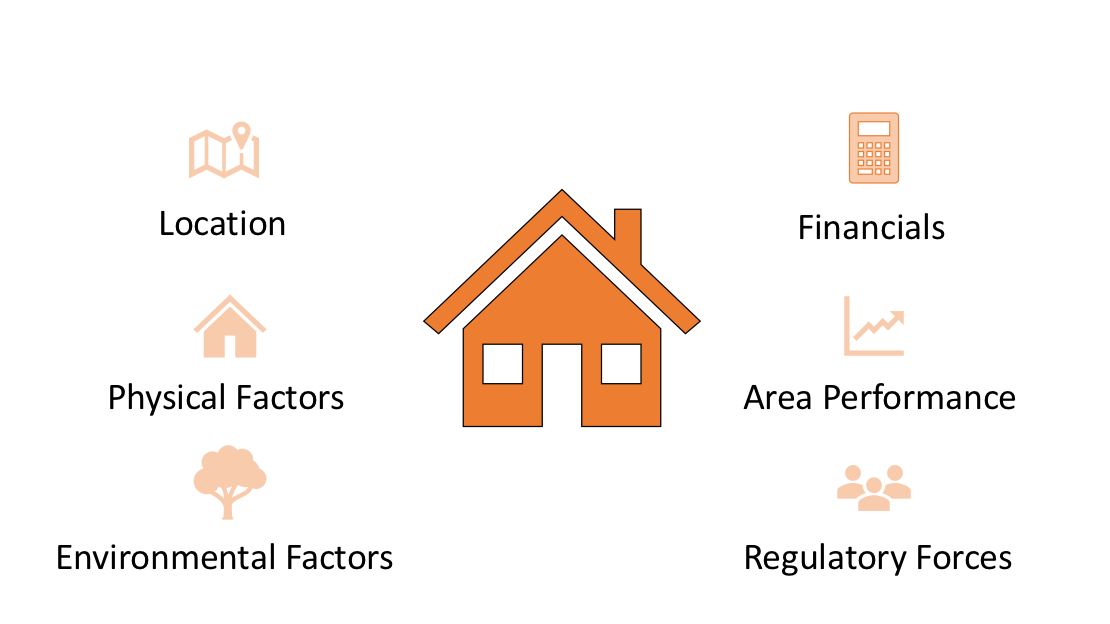

, eco-friendly area, picturesque views, and the neighborhood's condition variable plainly right into household home evaluations. An essential when considering property area is the mid-to-long-term view regarding just how the location is anticipated to evolve over the investment duration.

Excitement About Amur Capital Management Corporation

Extensively evaluate the possession and designated usage of the instant areas where you plan to spend. One means to gather information concerning the leads of the area of the building you are taking into consideration is to get in touch with the city center or various other public companies in fee of zoning and urban preparation.

Property evaluation is necessary for funding during the purchase, sale price, investment evaluation, insurance, and taxationthey all rely on property appraisal. Typically utilized realty appraisal methods include: Sales contrast method: recent equivalent sales of residential properties with similar characteristicsmost common and appropriate for both brand-new and old homes Cost technique: the price of the land and construction, minus devaluation suitable for new construction Revenue approach: based on expected cash inflowssuitable for leasings Offered the low liquidity and high-value financial investment in realty, a lack of quality on function may lead to unforeseen outcomes, consisting of financial distressparticularly if the investment is mortgaged. This offers normal revenue and long-lasting worth recognition. This is generally for quick, tiny to medium profitthe typical building is under building and sold at a revenue on completion.

Report this page